Getting into an accident while on a motorcycle in Michigan can be a life-changing event. The effects the injuries have on the injured person and his or her family is immense. Finding out the negligent driver who caused the crash had no insurance, or was uninsured, is like adding salt to an open, fresh wound.

That is why is it important to understand motorcycle insurance and the importance of obtaining uninsured motorist (UM) coverage for your motorcycle. More than 25% of Michigan motorists don’t have insurance. Our team of aggressive and experienced Michigan motorcycle accident lawyers can help you obtain compensation, even if there if the negligent driver is uninsured.

What is a Car Accident Negligence Case in Michigan?

Under the law, a person is entitled to compensation for the pain and suffering caused by another driver following a Michigan motorcycle accident. This occurs when another person disobeys traffic rules, like running a red light or making an illegal turn, thus causing a crash. When this happens, under Michigan law the injured person can make an injury claim for compensation against the driver and owner of the at-fault vehicle and their auto insurance company.

In Michigan, so long as the person who caused the crash was at-least 50% at-fault for causing the car accident, that person can be held responsible for the injuries sustained by the injured individuals. This is called a negligence claim.

What is Motorcycle Uninsured Motorist Coverage?

Uninsured motorist (UM) coverage provides compensation to an injured motorcyclist or passenger for pain and suffering if they are injured by an uninsured driver. In essence, this type of insurance coverage steps into the shoes of the uninsured driver. Besides providing money for pain and suffering, it can also cover medical expenses, lost wages, loss of income, scarring and mental anguish when an uninsured vehicle causes a crash.

UM coverage is a type of insurance that Michigan motorcycle operators can and should purchase for their bikes.

UM coverage is sold by your own motorcycle insurance company. It is relatively inexpensive. The coverage is not mandatory so you must ask for it. Given the large number of uninsured drivers operating car and trucks on Michigan roadways, it is a very smart insurance coverage to have. If you have questions about uninsured motorist coverage for motorcycles, contact a Michigan motorcycle accident lawyer to get answers. They often know more than an insurance agent about what this coverage does, and when it kicks in.

How Does Uninsured Motorist Coverage Work?

The way UM coverage works is your own insurance company steps into the shoes of the uninsured at-fault driver and pays the pain and suffering claim. That way, you are not punished simply because you had the misfortune of getting struck by an uninsured driver while driving your motorcycle.

UM claims for a motorcycle rider or passenger are set up in much the same way an auto accident claim is established. A letter must be provided to your own insurance carrier asking to open a claim.

Uninsured motorist claims are contractual in nature, meaning an injured claimant must follow the rules set forth in the insurance policy. Often, this requires the injured person to keep the motorcycle insurance company informed of treatment and to allow them to order medical records and bills.

An experienced and helpful Michigan motorcycle accident lawyer can help explain the process of filing and receiving UM benefits. A lawyer can also protect you from an insurance adjuster taking advantage of what can be a complicated process.

What is Underinsured Motorist Coverage?

Sometimes, the at-fault vehicle does have insurance, but it is not enough to cover the injuries it caused. The minimum amount of liability insurance is $50,000 in Michigan. But what happens if the injuries are worth more than that? In this situation, you can turn to your own motorcycle insurance carrier for underinsured motorist (UIM) benefits.

Like uninsured motorist benefits, underinsured motorist benefits are not mandatory. It must be purchased as part of your normal motorcycle policy. It is not expensive and can provide a lot of compensation for broken bones, back pain, road rash, and other injuries following a motorcycle crash in Michigan.

How Does Underinsured Motorist Coverage Work?

For example, if you carry $100,000 in UIM coverage for your bike, and you are hit by a car with $50,000 in liability coverage, you can obtain the $50,000 from the at-fault driver’s liability insurance carrier. Then you can also obtain an additional $50,000 ($100,000 minus the $50,000 already received) in compensation from your own motorcycle insurance company.

Because UIM benefits are contractual in nature, there are many pitfalls. It is always smart to get the advice of an experienced Michigan motorcycle accident lawyer to help you in a situation where the driver is not insured. For example, if you settle or take the money from the at-fault driver’s insurance company without first getting consent from your own insurance carrier, you forfeit your right to get under-insured motorist benefits.

How Do I Know if I Have Uninsured Motorist Coverage?

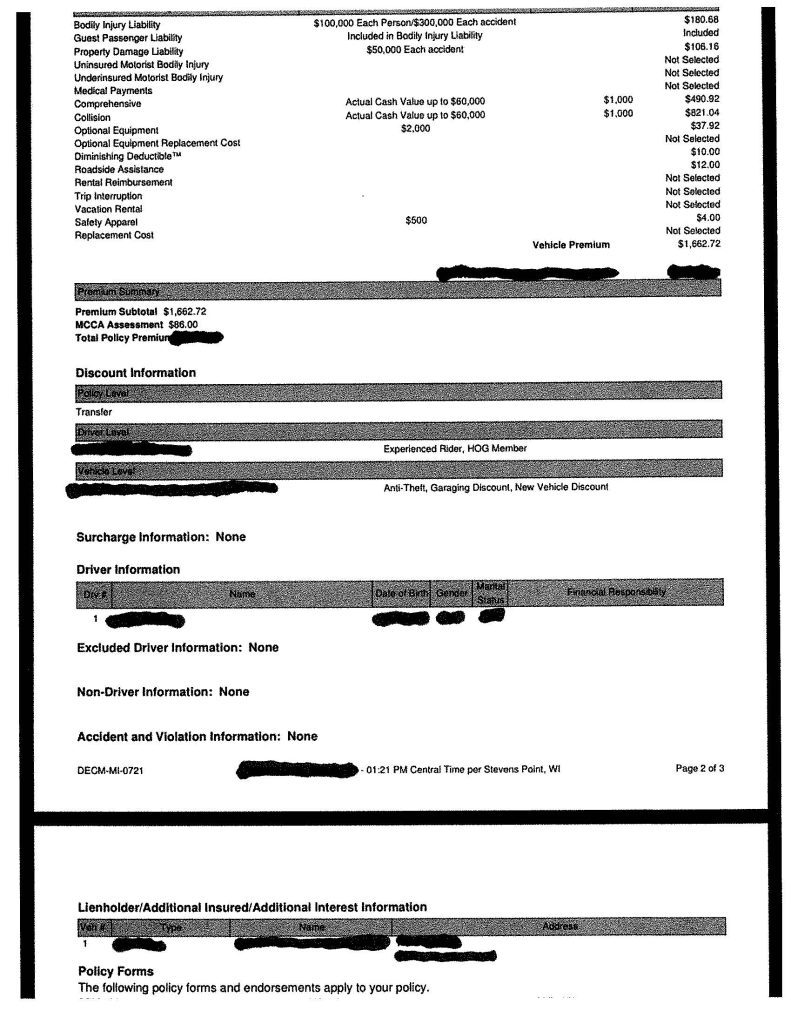

The easiest way to find out of you have uninsured motorist coverage on your motorcycle (or your car) is by looking at the declaration sheet of your insurance policy. When you buy insurance, you always get a declaration page, commonly known as a dec page. It looks like this below:

As you can see, the declaration sheet will list all the coverages a person purchased for their motorcycle insurance. For example, in this policy, the policyholder purchased $100,000/$300,000 of Bodily Injury Liability. This means if he ever causes a crash, his own insurance company will pay up to $100,000 in compensation to each injured person and $300,000 for all individuals injured in the same crash.

He also purchased insurance for a guess passenger. This covers the passenger if he or she is injured to the negligence of the motorcycle operator. This particular policy also includes collision coverage and comprehensive coverage, subject to a $1,000 deductible. Collision insurance covers the motorcyclist for the damage to his bike if a crash occurs. Comprehensive coverage covers him if his bike is stolen or damaged due to hail or bad weather.

But take a look at both the Uninsured Motorist Bodily Injury and Underinsured Motorist Bodily Injury section. Notice that is says “Not Selected.” This means this person did not purchase UM or UIM coverage. What makes this very frustrating for him and our motorcycle accident attorneys is that the driver who caused the crash did not have any insurance on her car. This makes it very difficult to get any compensation for his injuries, which included horrible road rash, scars and a neck injury.

Michigan Uninsured Motorcycle Lawyers Are Ready to Help

Obtaining compensation for these injuries caused by a negligent driver is an important way to help put the pieces back together.

Following a motorcycle crash, it is important the right steps are taken. Especially if the other driver doesn’t have insurance. The motorcycle accident attorneys at the Lee Steinberg Law Firm, P.C. have helped motorcyclist owners and passengers throughout Michigan get the money they deserve.

We can walk you through the process, answer all of your questions, and obtain the money and justice you deserve. Please our law firm call toll-free at 1-800-LEE-FREE (1-800-533-3733) for a free consultation. There is never a fee until we win your case

Video transcript 1

Uninsured motorist benefits is something that you can purchase through your auto insurance company or your motorcycle insurance company. And what it does is it pays for pain and suffering, or in some cases lost wages and medical bills if another person causes the accident who’s uninsured. So if you’re hit by an uninsured driver. There’s estimates in some parts of Michigan, 25 to 40%, or even 50% of motorists don’t have insurance. So I recommend everybody purchase uninsured motorist coverage, both for their bike and their car. It’s not expensive. In fact, it’s some of the cheapest insurance you can buy.

And what it does is it steps into the shoes of the at fault negligent driver who caused the crash. It’s not mandatory. You don’t have to buy it, but you should absolutely have it, because if you’re involved in a bad wreck that someone else caused and they’re uninsured, that person isn’t going to be collectible. You’re not going to get any money, but you can turn to your own insurance company for compensation. And we’ve been able to get hundreds of thousands of dollars or more for people who in another situation that they didn’t have a coverage would have nothing.

Video transcript 2

Underinsured motorist coverage. Now, this is different than uninsured motorist coverage. Underinsured motorist coverage, also known as UIM coverage, works this way. All right, let’s say you’re in an accident. Someone else causes the crash. And they have insurance, but it’s not enough to cover the injuries that you sustained from the accident. What you can do is you can go after the other person who caused the crash. You can get their policy amount. Let’s say it’s the 50,000 minimum in Michigan. And then what you can do is you can file a claim with your own insurance company, if you have this, for underinsured motorist coverage.

So, for example, let’s say that you have an injury that’s worth $250,000. I’m just making this up. And the person who causes the accident only has $50,000. You can get the 50,000 from the at-fault driver, who caused the crash, from their insurance company. And then you can make a claim for 200, so 250 minus the 50 you were already paid, so an additional $200,000 from your own insurance company, if you have it.

This is another type of coverage everybody should have now. It is so cheap. I’ve seen policies where it’s literally $20 for six months for a lot of insurance. And again, you don’t know what another person has. There’s no reason you should be at their mercy. If they cause a broken leg or you can’t work for six months and they have barely any insurance, why should you have to live with that for the rest of your life? Have the insurance. Talk to your insurance agent. Get the UM. Get the UIM coverage. And you’ll be happy if, heaven forbid, you need it.